Capital

preservation

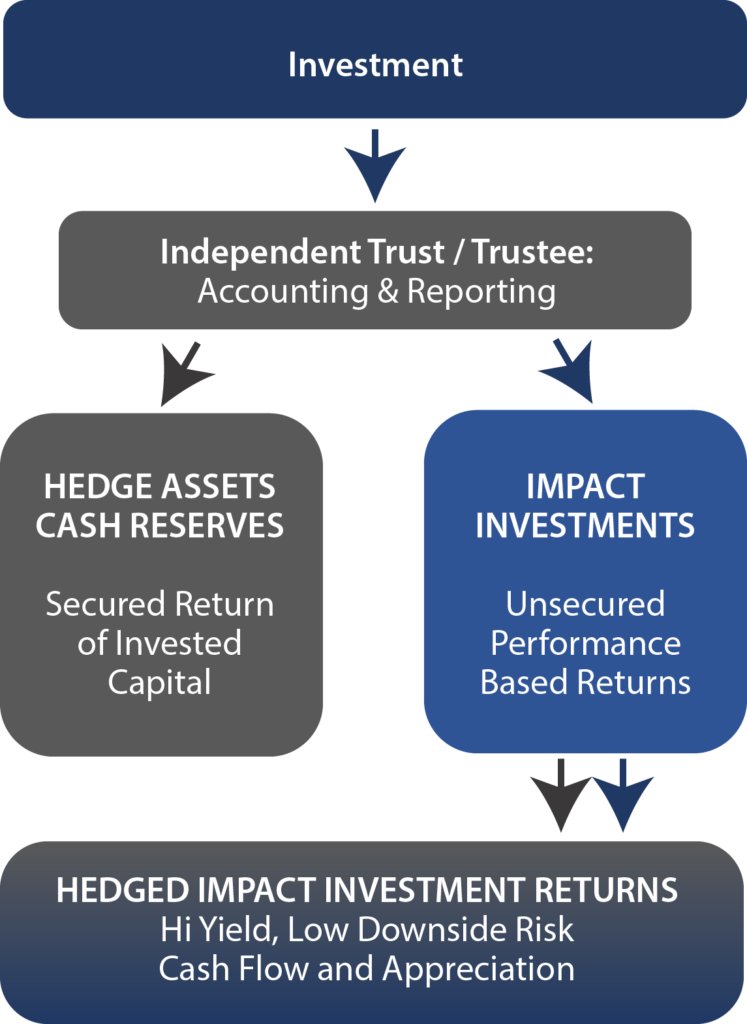

Cogent has developed an investment methodlogy that can secure all or part of an investment against potental loss or dimunition in value. As a result, we are able to implement capital structures that reduce risks and volatility, protect against downside losses, while generating attractive yields.

- We collateralize the return of invested capital irrespective of the performance of Cogent or its portfolio companies.

- A portion of each investment is allocated to acquire hedge assets that mature for up to 100% of the original investment.

- Cogent intends to utilize insurance-based securities issued by American insurance companies rated “A-” or better by Standard & Poor’s.

- Investment upside is generated by the performance of portfolio companies and maturity of the hedge assets.

- Our structure assures that the worst-case scenario for any investor is the return of originally invested capital.; and creates a self-liquidating transaction for the issuer.

Investors can substantailly mitigate investment and operating risks in virtually any investment while advancing opportunities for attractive long-term risk adjusted Returns on Investment (ROI) and Annualized Returns (IRR).

Cogent’s structures and strategies enable companies and potential investors to calibrate and mitigate financial and operating risks; reduce their overall costs of capital, reduce equity dilution, fund subsequent financing rounds, and create self-liquidatiing repayment transactions.